New information has been published that the bailout of the Banks were much bigger than ever reported. Like the very unproductive middle ages where the very rich kings simply took the towns people’s money and used it to secure their position and made up their own rules and lies along the way. The difference here in our generation is that we do not have a Robin Hood to save us.

From the start of the financial crisis there was the big bank crisis. The top guys at the banks simply told our government to think! It was almost blackmail. Give us your money or we will fail and take all your citizens money with us. So Obama gave the banks our money.

From the start of the financial crisis there was the big bank crisis. The top guys at the banks simply told our government to think! It was almost blackmail. Give us your money or we will fail and take all your citizens money with us. So Obama gave the banks our money.Pick up this months “Bloomberg Markets “ magazine and read it for yourself. In this publication the numbers have been released to the public on how much of our tax dollars were just given away without our vote or permission. Of course none of the money ever trickles down to go back in our pockets. Just like the poor villagers in the middle ages, we get nothing while this countries royalty manages to find money to keep them prospering.

Thanks to the Freedom Of Information Act documents can be released from the government to the public. Yes, thank goodness we get to have some glimpse of the wheeling and dealing that goes on in our government where no one is held accountable for anything and they never go to jail and they never loose their income or job.

Thanks to the Freedom Of Information Act documents can be released from the government to the public. Yes, thank goodness we get to have some glimpse of the wheeling and dealing that goes on in our government where no one is held accountable for anything and they never go to jail and they never loose their income or job. What we learn is that the bail out was far bigger than the Federal Reserve or the members of Congress knew at the time. Of course we, the public get to know even less. We are too busy loosing our jobs and homes and savings. In fact, from the start of the financial crisis in 2007 through March of 2009, the Federal government loaned or guaranteed banks about $7.7 Trillion Dollars.

That amount of money represents about half of all the goods and services that is produced by the United States economy. I majored in Economics in College and this amount of money is unbelievable to be given to a handful of banks that blackmailed the government into giving it to them. Some accounts take the position that the Government blackmailed the banks into taking the money and that is why there was no oversight or restrictions on how they used the money. Either way the bankers got richer, they made more money for their banks and shareholders and ultimately rewarded themselves and their close associates with multi-million dollar bonuses. Think how many homes could have been saved if they just used that money to actually reduce the outstanding mortgages.

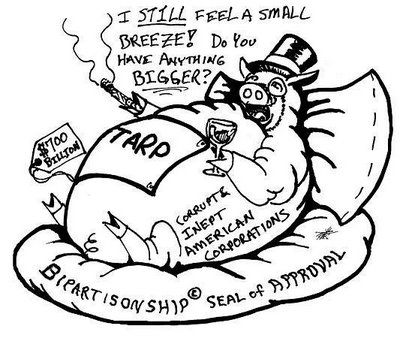

That amount of money represents about half of all the goods and services that is produced by the United States economy. I majored in Economics in College and this amount of money is unbelievable to be given to a handful of banks that blackmailed the government into giving it to them. Some accounts take the position that the Government blackmailed the banks into taking the money and that is why there was no oversight or restrictions on how they used the money. Either way the bankers got richer, they made more money for their banks and shareholders and ultimately rewarded themselves and their close associates with multi-million dollar bonuses. Think how many homes could have been saved if they just used that money to actually reduce the outstanding mortgages.Lets put it into even more prospective. That number represents 7 times the 700 Billion dollars in aid provided by the Treasury Department better known as the TARP program. No not the tarp you use to move leaves around or cover your boat. The Troubled Asset Relief Program. You don’t need to know that either, poor villager, you won’t see any of that money either but you will pay taxes to your bloated government.

On just one day, December 5th 2008, America’s banks borrowed $ 1.2 Trillion Dollars from the Federal government. And the President and Congress gave the banks money like it was raining in a porn club, no restrictions. The villagers of America can’t even get a decent car loan these days!

On just one day, December 5th 2008, America’s banks borrowed $ 1.2 Trillion Dollars from the Federal government. And the President and Congress gave the banks money like it was raining in a porn club, no restrictions. The villagers of America can’t even get a decent car loan these days!The banks borrowed that money from the Federal government with as little as 0,01% interest. As a result , the banks were spared the need to sell off assets that paid much higher rates of interest. The last time I heard the term 0.0 % was in the movie Animal House when they told John Belushi character his college grade point average!

Bloomberg Magazine estimated that the banks made a $13 Billion profit on the spread on the money they borrowed virtually free from the Feds. The nations six largest banks profited from this scam of our tax paying dollars . They are Wells Fargo, Bank of America, Morgan Stanley Citigroup, Goldman Sachs, and JP Morgan Chase.

Bloomberg Magazine estimated that the banks made a $13 Billion profit on the spread on the money they borrowed virtually free from the Feds. The nations six largest banks profited from this scam of our tax paying dollars . They are Wells Fargo, Bank of America, Morgan Stanley Citigroup, Goldman Sachs, and JP Morgan Chase.We all have an account in one of these banks do you think they should have given us more interest on our money in their bank? Nope , that would have been the right thing to do and we all would have been a little better off.

Bottom line, this blatant greed by our nations banks saw them actually grow by 39% . This is calculated from September 2006 , $6.8 Trillion dollars to the end of 2011 a growth to $9.5 Trillion dollars. The Feds say that all their loans to the banks were backed up by assets or collateral. Yeah, our bankbook assets. They claim the loans have now been repaid. Really???

No comments:

Post a Comment